HOW EVERY CONTRACTOR CAN EASILY UNDERSTAND THEIR P&L!

When it comes to the financial management of a trade business… it’s the owner who must be in the driver’s seat! Not your bookkeeper, not your accountant… it’s ultimately on YOU to drive the financial performance of your business.

But here’s the problem…

The large majority of trade business owners that we talk to, have never been taught how to read, interpret and actually UNDERSTAND their financial statements…

So, how could they ever expect to use these documents to make better informed decisions?

They can’t.

Now… this is a problem.

Because there are a few key things that every trade business owner should be in charge of from a financial management perspective:

|

|

And these all require the basic fundamental knowledge of understanding financial statements!

You don’t have to be an accountant, maths genius or financial guru… you just need to understand the basics!

There are three financial statements:

- Net Income Statement

- Cash flow Statement

- Balance Sheet

These financial statements measure the vital signs of your business’s operations. They provide you with critical information about how much profit the business is generating, how much cash you have in the bank to run the business, and the overall health of the business at any point in time – information that in turn allows you to make wise and timely decisions that will keep the business humming like a finely tuned engine!

Why is this important?

Your bookkeeper likely isn’t going to make those decisions for you. They are there to make sure you have accurate and timely records of business transactions to send to your accountant.

And your accountant is not going to make those decisions for you either… they are there to prepare your taxes and make sure you don’t get in trouble if you’re audited by the ATO.

It is entirely possible for both your bookkeeper and accountant to be doing their job perfectly, while you are steering your business into a financial danger zone. You could be spending money on the wrong things, chasing the wrong work, signing up with the wrong clients, be overpaying for things, have too many expenses, have too much money owed to you, not invoicing, taking out crazy amounts of debt without understanding how fast it can sink your business, and the list goes on…

It’s YOU who is in the driver’s seat.

Let’s talk about the profit and loss statement.

The profit and loss statement shows whether your business is generating a profit, breaking even, or showing a loss.

If the number on the bottom line of the statement is positive, you’re making money. If it’s zero, you’re breaking even. If it’s negative, you’re losing money.

It’s really that simple.

The bottom line is what’s left after every direct and indirect expense is paid from net revenue. That number is why you’re in business. That number is net profit.

Why should you care whether your business is making net profit or not? Because when you run a business, you’re taking on a lot of risk! Not to mention enormous sacrifices in time, effort and energy.

So, net profit is your personal reward.

Some trade business owners camp out in no-profit territory for months, others somehow hang on for stress filled decades sometimes with the use of credit cards and loan debts. Without sustained and growing profits, your trade business may be spinning its wheels (at least at the moment), but it won’t be getting anywhere.

There are many ways to increase a business’s profits, and some of them can be implemented quicker and easier than you can imagine. Click here to check out our FREE 77 bullet proof profit boosters resource, that’s a great place to start!

So, understanding and regularly reading your profit and loss statement will allow you to make better business decisions; you’ll make faster course corrections before a crisis hits, and you’ll be more resilient than the competition when the market around you is changing.

This is your key to long-term business success.

Your profit and loss statement lets you know if profits are increasing or decreasing. Keep in mind now, that profits will fluctuate monthly based on your marketing and sales activities. The real challenge is to anticipate those high and low-profit months so the business can always pay its expenses and stay viable.

Here are some key questions it answers:

- Is my business making any money?

- Is it making the money I want it to be? If not, why? Am I doing the business activities that result in the profit I want to make?

- Are my products and services the right ones?

- Am I pricing our products and services so that we’re not cheating ourselves out of a reasonable return while still remaining competitive in the market?

- Is my gross profit margin robust enough to run the business?

- Do I know what my true direct costs are?

- How do I know my marketing efforts are paying off?

- Do I have the right mix of work type/clients?

- How can I work half as hard and make twice the money?

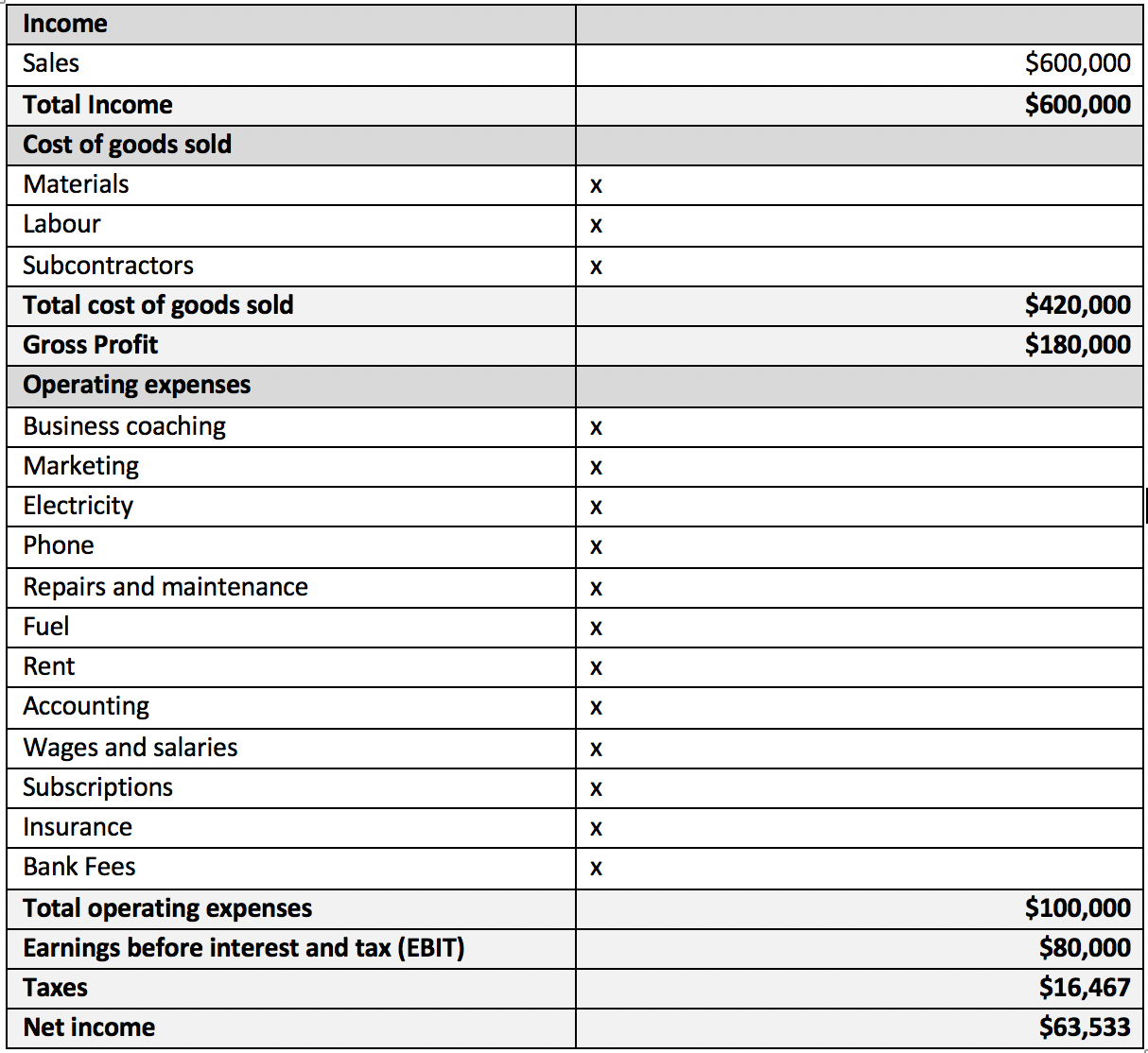

Now, the bird’s eye view of the Profit and Loss Statement is as follows:

- Revenue (Business income): This is sales (i.e. the money coming into your company).

- Less - Cost of Goods Sold (COGS): These are your direct costs related to delivering your service.

- Gross Profit (GP): This is the remaining money left over after your job costs have been paid. (how do you increase this? Look at your pricing, productivity and labour utilisation)

- Less – Operating Expenses: These are expenses that are required to keep the doors open (e.g. rent, electricity, salaries, marketing, etc.)

- Operating Income: This is the gross profit left over after operating expenses have been paid.

- Less – Taxes: These are expenses that you can’t forget to pay!

- Net income: This is what’s left over for the business – the bottom line. This number reveals if the business is profitable and how large that profit is.

You’re going to want to be looking at this report WEEKLY! That and your accounts receivables (money owed to your business), as profit on paper doesn’t always mean it’s there…

With the profit and loss…

REVIEW SALES:

- Have sales increased or decreased? Calculate in dollar terms AND as a percentage

- What caused the situation? What can be done? If sales are flat (that is, similar over time) then the business is actually declining…

- Compare actual sales with your sales goals for the same period, noting reason for any material variances. How are sales tracking against your goals? Are you on track?

- What are the reasons for any decreases in sales? Is it temporary or likely to continue? What can be done to fix this issue?

- Have sales increased or decreased from the previous year (calculate both dollar amount and percentage)?

REVIEW TOTAL EXPENSES (COGS):

- Have expenses increased or decreased? Have expenses increased by more than the sales increase?

- Cost of goods sold and, therefore, gross profit should be considered. If sales have increased, it is reasonable to expect that cost of goods sold will also increase? If sales have decreased and cost of goods sold has increased, then we can expect to see a corresponding decrease in gross profit, and ultimately in the gross profit margin? If so, this should be a concern and investigated.

- Are there any increases or decreases in larger expense items? Many expenses may be variable in nature, meaning they increase and decreased relative to sales. If sales have increased for the period, have expenses also increased?

- If the expense is classified by function (for example, selling and administration, marketing, employee expenses etc.), is analysis also undertaken at this level? Alternatively, expenses may be classified in the income statement by nature (or type) such as personnel, building occupancy, depreciation, and advertising.

- Have expenses increased or decreased from the previous year (calculate both dollar amount and percentage)? Look for major expenses, such as cost of goods sold (COGS) to determine trends. Has the increase in expenses outstripped the increase in revenue? If so, this will result in a reduction in net profit. Also look out for unusual expenses and determine whether they are ‘one-off’ expenses.

REVIEW THE NET PROFIT BEFORE INCOME TAX:

- Has net profit before (and after) income tax increased or decreased? Was it because of sales or expenses (or a combination of both)?

REVIEW THE NET PROFIT AFTER INCOME TAX:

- Has net profit before (and after) income tax increased or decreased? Was it because of sales or expenses (or a combination of both)?

Now that you have a clearer understanding of what you can learn from the profit and loss statement (is the business making a profit or showing a loss), you have a framework for making decisions. The challenge is to use this information to manage your business so that you are maximising profits while keeping a tight rein on costs.

Profits are one of the healthy vital signs of a sustainable, well managed business. If you are actively monitoring your profits or lack thereof, you can implement the necessary strategies to adjust and improve it through marketing, sales conversion, efficiency, pricing and so on.

If you’re not tracking or understanding the story/performance of your business, you can’t tell if your pricing is accurate, and as good as it can be, you can’t tell if you are utilising your tradespeople and equipment properly. Are your overheads too high or too low? Is your marketing working? Is your conversion rate high enough? Are you doing the right marketing and sales activities etc.

It’s really difficult to tell, because there is no transparency around the performance of the business and its almost certain that at some stage you’re going to run out of money and/or time.

The profit and loss statement is a key tool to be used to know what’s happening, you’re getting feedback, through a feedback cycle. When you understand how your business is performing financially, you make changes from there.

It also gives you confidence. It’s much better to know you’re in trouble and why than to have no idea, the same way that if you know how you’re doing, you can take action to do even better. Use this statement to drive your profitability – WEEKLY!

Don’t wait until the end of the year to realise you aren’t making the profit you want, get a handle on this now!

If you're an electrician, plumber, painter, carpenter, or any other trade business owner who is looking to take your business to the next level, click here to learn more about how our team can help!