“CASH IS KING!”

You’ve likely heard this phrase before, right?

It’s plastered everywhere and often shouted from the rooftops…

But I want to put forward a slight variation.

I believe, that when running a business, it is actually cash FLOW that is king!

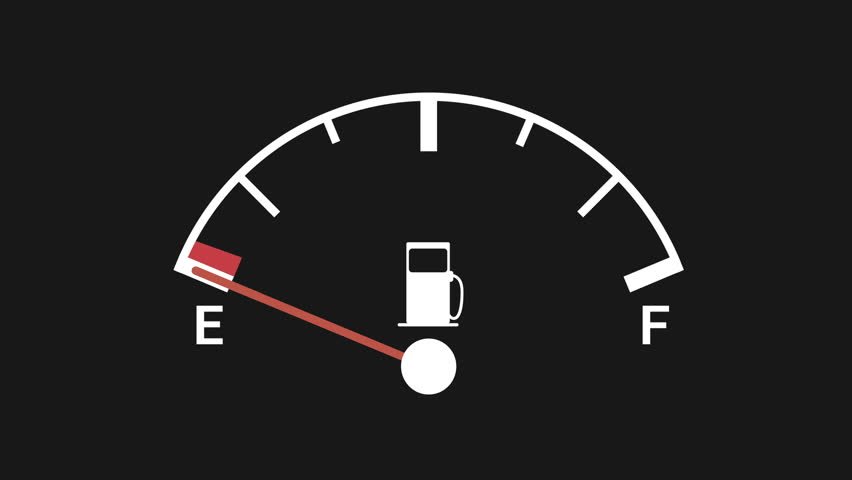

Cash is to your business, like fuel is to your car.

It’s the fuel that ultimately keeps the business humming along!

Every business will burn cash at different rates.

So, you need to be able to measure it accurately, and I mean ACCURATELY… this rules out any guessing! Guessing leads to bankruptcy. When you run out of cash, it's game over.

So, managing cash flow is mission critical to keeping your business alive. This is why there is urgency in learning how to read your cash flow statement!

Your Cash Flow Statement measures the flow of cash in and out of your business.

You start with a positive cash balance (hopefully) at the beginning of the month. Cash comes in from customer payments, investments or loans. Cash goes out to pay bills and salaries and your ending cash is brought forward to begin the cycle again the following month.

There are THREE primary sources of cash for small businesses. You can get cash from operations, bank loans (which must be paid back) or investors (who typically buy equity in your business).

Cash from your operations is your premium fuel, this is cash generated directly from selling products and services to customers at a profit and getting paid for them.

However, there are a number of factors that influence whether or not that premium fuel will make it into your business’s fuel tank in time to keep it from hitting empty.

Freeing yourself from worrying about your finances starts with knowing your current cash balance and what you expect it to be in the future, plain and simple.

This knowledge allows you to focus on building your business strategically and plan around accurate cash figures.

If the cash position is unfavourable, then you can develop a plan to RESOLVE the problem.

The time to deal with a cash shortage is NOT when it is occurring.

So, the MORE cash, the healthier the business.

If you don’t know when cash is coming in and out (on a relatively up to date basis), then your ability to grow, purchase more tools or replace assets, pay debts, accommodate unforeseen shocks, pay your staff, take money out of the business etc. is incredibly limited.

You may be thinking, ‘Oh I have an accountant and they handle this stuff’, I guarantee you that they don’t.

It’s YOUR job to manage your cash position, NOT your accountants!

Click here to see our post on why your accountant is NOT your CFO!

So, understand how cash flows through your business, and get on top of you cash management i.e. understand how much you have and why!

Then you can improve!

If you want to BOOST your cash flow in the next 90 days OR LESS, then consider the three fundamental steps to improving cash flow:

- 1Maximise Profits: The most effective way to improve cash flow is to make the operation of your business as profitable as possible (or to reduce losses/keep losses to a minimum). Running more profitable jobs, reducing costs where you can and bringing in the cash is best practice for good cash flow.

- 2Increase Cash Coming In: Maximise as many strategies as you can to increase the rate at which money comes into your business. Take deposits. Invoice as soon as jobs are complete! etc.

- 3Decrease Cash Going Out: Stopping or slowing down the rate at which money leaves your business is also incredibly important.

Step One: Maximise Profit

Maximising profits is a MASSIVE topic in itself!

A good place to start on though is by downloading our FREE resource: 77 Bullet Proof Profit Boosters.

In this book, you will learn how to skyrocket your profit margin to new heights following 77 fool proof & battle-tested strategies from the Trade Business Success Margin Mastery Playbook. Click here to get your hands on a FREE copy today!

Step Two: Increase Cash Coming In

And so on… (speak to your accountant or bookkeeper for more suggestions – OR contact us!)

Step Three: Decrease Cash Going Out

And so on… (speak to your accountant or bookkeeper for more suggestions – OR contact us!)

If you implement any number of these strategies to maximise profit, increase cash flowing into the business and decrease cash flowing out – you WILL boost your cash flow in the next 90 days OR LESS!

If you're an electrician, plumber, painter, carpenter, or any other trade business owner, and you want to have the confidence to drive strong financial performance in your business, then click here to access our FREE Master Your Financial Dashboard Download where you will learn how to master your financial dashboard, so you can navigate the numbers and finally drive strong performance in your business with complete confidence!